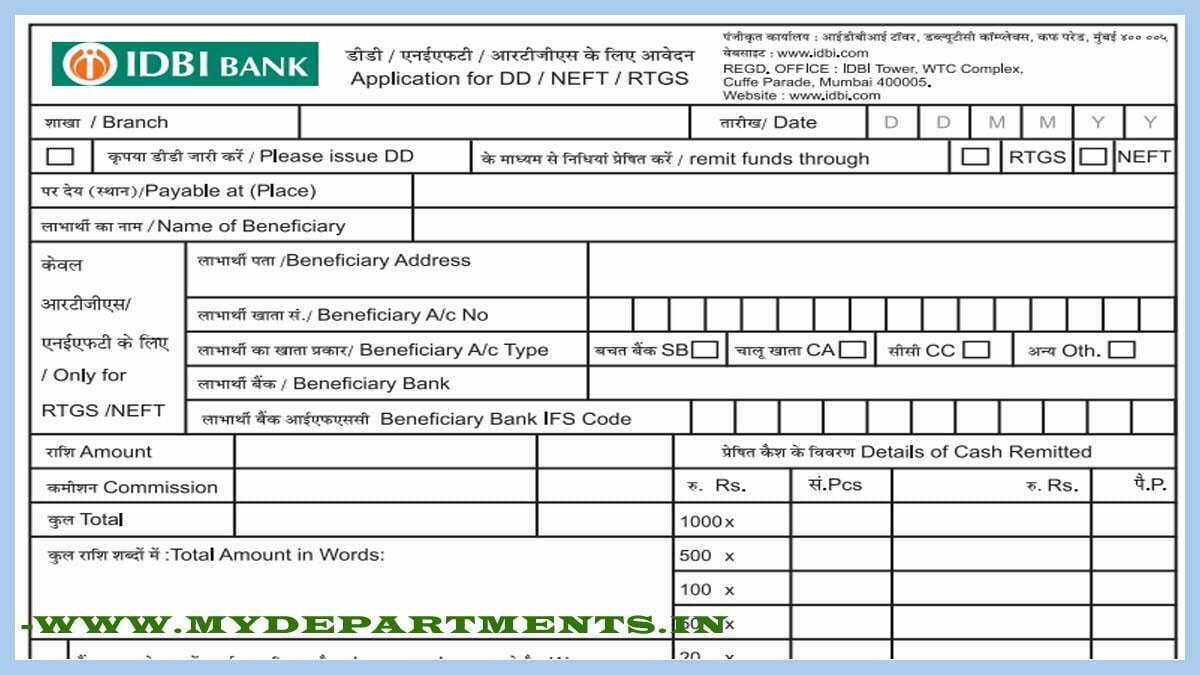

IDBI RTGS NEFT form download. Know about Timing, Charges, Benefits of IDBI Bank NEFT RTGS application form. Visit www.idbibank.in. So, let us start the article and know more about the IDBI RTGS / NEFT Transaction Form.

IDBI RTGS Form

RTGS is an Electronic Fund Transfer System that enables secure, safe, and fast transfer of money from one bank to another bank in Real-Time. IDBI bank has come up with the facility of RTGS and NEFT. Customers can use these services to transfer money efficiently online and offline. Each and every fund settlement will place in the records of the Reserve Bank of India.

IDBI NEFT Form

NEFT is a national Electronic fund transfer system where all the transactions are processed in batches. It is done in the time interval. Each and every account holder has the option to use NEFT services to transfer funds in a simple way.

What is the Difference between the IDBI RTGS & NEFT form PDF?

IDBI provides the same form for both RTGS / NEFT Transactions. We can use the same application form for both transactions.

How to Fill IDBI Bank RTGS / NEFT Offline

- Visit the IDBI branch nearby.

- The bank will provide the RTGS / NEFT form (We Already know that form is the same for both).

- Select the option clearly which transaction should be done RTGS or NEFT.

- Fill in all the details of the beneficiary clearly without any mistakes. Like Account Number, IFSC code, etc.

- Write all the details of the remitter clearly. (The mobile number is important).

- Submit the Form.

How to Fill IDBI RTGS / NEFT Form Online

- Firstly open Google, search, and navigate to the IDBI Online Login page.

- Log on to your IDBI Online Account.

- Choose “RTGS / NEFT ” under the option “Fund Transfer” and click on “Add Beneficiary”.

- Fill in all the details of the Beneficiary name, account number, and IFSC code.

- Click on confirm to add all beneficiary details.

- If you need to send the amount, select the beneficiary details and type the amount to be sent and click on the submit.

- Once the transaction was completed. The Account holder will receive a mail.

Download IDBI Bank RTGS NEFT Form

Customers can download the application form on this web page. All they need to do is, Just click on the below button to download. The form will open in a new tab. Click on the link.

IDBI Bank Charges

RTGS is useful for transferring more than 2 Lakhs. The Transaction done through the bank will have service charges. No charges are waived on the transactions made online.

| Transaction Amount | Service Charges (Rs) |

|---|---|

| Rs 2 lakh to Rs 5 lakh | 30/- per transaction |

| Above Rs 5 lakh | 55/- per transaction |

NEFT is useful for transferring up to 2 Lakhs. Transaction charges vary based on the transfer amount. Details for NEFT charges in IDBI are given below.

| Transaction Amount | Service Charges(Rs) |

|---|---|

| Up to Rs 10,000 | NIL |

| Above Rs 10,000 to Rs 1 lakh | 5/- per transaction |

| Rs 1 lakh to Rs 2 lakh | 15/- per transaction |

| Above Rs 2 lakh | 25/- per transaction |

IDBI Bank Timings

Anyway, RTGS transactions can be made online 24×7. But transactions made in the bank branch will have timing. IDBI RTGS timings table is given below.

| Banking Days | Timings |

|---|---|

| IDBI RTGS on working weekdays | 9:00 AM to 4:15 PM |

| On working Saturdays | 9:00 AM to 1:00 PM |

| On Sundays and Public Holidays | Transactions cannot be done |

| Banking Days | Timings |

|---|---|

| IDBI NEFT on working weekdays | 8:00 AM to 6:30 PM |

| On working Saturdays | 8:00 AM to 6:30 PM |

| On Sundays and Public Holidays | Transactions cannot be done |

Benefits of RTGS and NEFT

RTGS (Real Time Gross Settlement ) is one the best form of transferring the amount. Nowadays, when time is the essence. The banks have proposed a good system like RTGS. Payments are the solution for a faster and most efficient settlement system for the customers.

Benefits of RTGS:

- Safe and Secure of funds transferring.

- It’s available on all days when the bank is working.

- Real-Time transfer of funds to the beneficiary account.

- Eliminates Settlement Risk and Systemic Risk.

NEFT (National Electronic Fund Transfer) is useful to transfer the amount below 2 lakhs. For the NEFT service, we can do it online easily. Transactions initiated online are free of cost. If you made an NEFT through a bank branch. A few service charges are a levy per transaction.

Benefits of NEFT:

- Secure and safe of funds Transferring.

- No levy of charges by RBI from Banks.

- Available for one-way funds transfer.

- PAN India Coverage through a large network of branches of all types of banks.

Frequently Asked Questions

How can one know which bank branches are part of the NEFT network?

The lists of bank branches participating in the NEFT system are available on the website of the Reserve Bank of India.

Can I transfer 1 crore through RTGS?

YES. you can able to transfer or deposit 1 Crore through the RTGS system. And it will be credited within 30 minutes.

What is faster NEFT or RTGS?

Generally, RTGS transactions will process in real-time. This means as soon as the request is raised from the bank. NEFT transactions will process in batches at regular intervals of time. RTGS is more fastest than NEFT.

What are the details required for NEFT transfer?

Like payee, beneficiary account number, IFSC code, bank branch, phone number.

For any more information about RTGS and NEFT transactions and charges. You can visit the official website: https://www.idbibank.in/service-charges.asp.