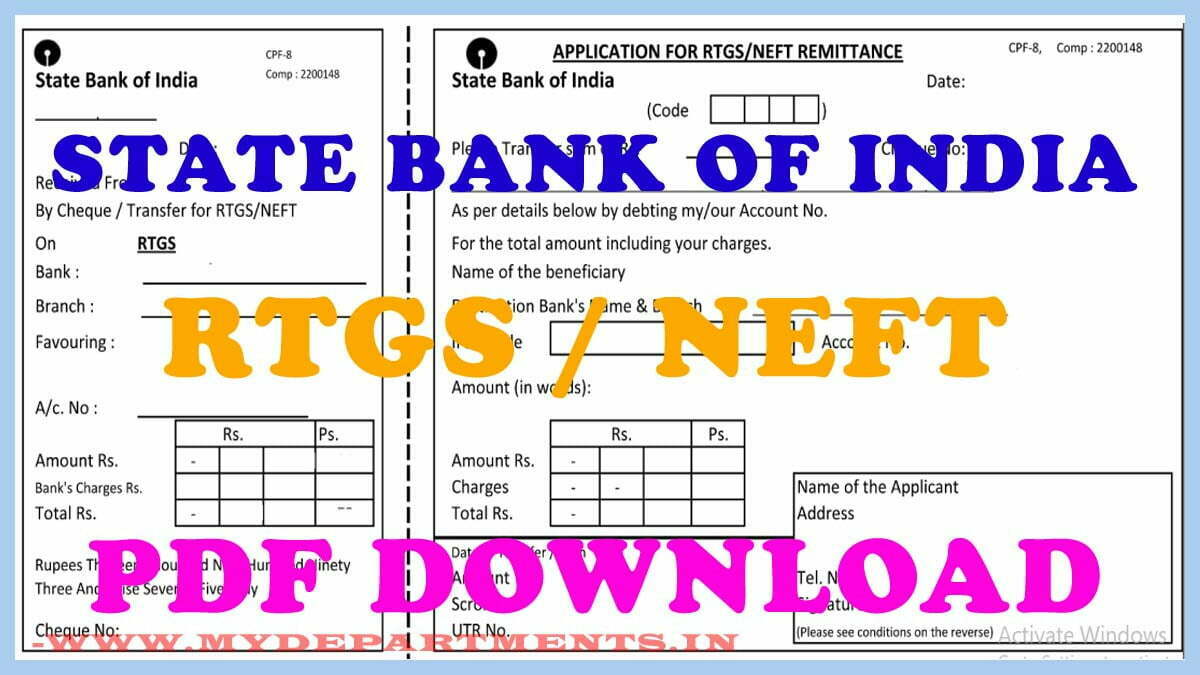

Sbi rtgs neft form pdf download. Latest State bank of india RTGS form PDF download online. For more information visit www.sbi.co.in/web/personal-banking/rtgs-neft.

SBI RTGS Form

SBI is the abbreviation for “State Bank of India”. It provides multiple banking and financial services. SBI is one of the best banks in Indian. It has millions of customers inside and outside India. SBI bank will do lakhs of transactions.

One of the services is RTGS and NEFT. These services are useful for fund transfer. Let’s have a brief explanation in this article.

What is SBI RTGS Transcation?

State bank of India will provide RTGS transactions for customers. RTGS is an acronym/abbreviation for “Real Time Gross Settlement”. These transactions are done in real-time. This means whenever the transaction is received. They are processed in real-time. “Gross Settlement” means settlements are done individually. To utilize this service. Customers need to download the state bank of India RTGS pdf document.

SBI NEFT Form

What is SBI NEFT Transaction?

NEFT is the acronym/abbreviation of “National Electronic Fund Transfer”. These transactions are not processed in real-time like RTGS. NEFT transactions are done in batches in intervals. Customers can send an amount of fewer than two lakh rupees.

Note: Same form is used for SBI RTGS & NEFT Transcations

How to Download SBI RTGS Form / NEFT Form PDF Download

Customers of SBI bank can download RTGS/NEFT form online. RTGS form is used to transfer a minimum amount of 2 lakh. NEFT form is used to transfer desired amount less than 2 lakh. Persons can download the State bank of India RTGS and NEFT Form below. Download Link.

To know more information visit https://www.sbi.co.in/web/personal-banking/rtgs-neft.

How to Fill Latest SBI RTGS PDF Form / State Bank of India NEFT Form

There are two sections in the SBI RTGS PDF form. Customers should fill the left side section. The right side section will be verified by the bank executive. In the left side section, Customers should fill the below information.

- Account number of the remitter and beneficiary account

- The amount needs to send to a beneficiary with a transaction service charge

- Mode of cash payment in remitter

- Name of the beneficiary bank and branch name

- IFCS Code of the beneficiary bank branch

- Name of the Beneficiary

Charges for State Bank of India RTGS Transaction

| RTGS Amount (Rs) | Transactions service charge (Rs) |

| 2,00,000/- to 5,00,000/- | 20/- (Exclusive of GST) |

| Above 5,00,000/- | 45/- (Exclusive of GST) |

Charges for SBI NEFT Transactions

| RTGS Amount (Rs) | Transactions service charge (Rs) |

| Up to 10,000/- | 2/- (Exclusive of GST) |

| 10,001/- to 1,00,000/- | 4/- (Exclusive of GST) |

| 1,00,001/- to 2,00,000/- | 13/- (Exclusive of GST) |

| 2,00,000/- | 20/- (Exclusive of GST) |

Timings of SBI RTGS Transactions

| Day | Timings |

| RTGS on working weekdays (From Monday to Friday) | 7:00 AM to 6:00 PM |

| RTGS on Working Saturdays | 7:00 AM to 6:00 PM |

| RTGS on Sundays and National Holidays | Transactions are not allowed |

Timings of SBI NEFT Transactions

| Day | Timings |

| NEFT on working weekdays (From Monday to Friday) | 7:00 AM to 7:00 PM |

| NEFT on working Saturdays | 7:00 AM to 7:00 PM |

| NEFT on Sundays and National Holidays | Transactions are not allowed |

For any more queries. Call to SBI Customer care number1800 425 3800. Visit the SBI official website www.onlinesbi.com.