Axis Bank RTGS NEFT form pdf download. How to download, Timings and charges for Axis Bank RTGS / NEFT form pdf online. Check the article to know more about the Axis RTGS / NEFT transaction form.

Axis Bank RTGS Form

NEFT is an abbreviation/acronym for “National Electronic Fund Transfer”. It is useful to transfer small amounts. NEFT transactions will process in regular intervals of time. Timing and Charges for Axis bank NEFT are below. No form is required to make an online transaction. An application form is required to make NEFT in the bank. You can download the AXIS BANK NEFT PDF form on this page.

RTGS is an abbreviation/acronym for “Real-time Gross Settlement”. Large amounts will transfer through RTGS. A person can send money from Axis bank to other banks in India. All the RTGS transactions will record in the books of RBI. Transactions will process individually and instantly after receiving.

What is the difference between the Axis RTGS & NEFT form pdf?

The same form is used for RTGS and NEFT transactions.

How to fill AXIS RTGS / NEFT Form

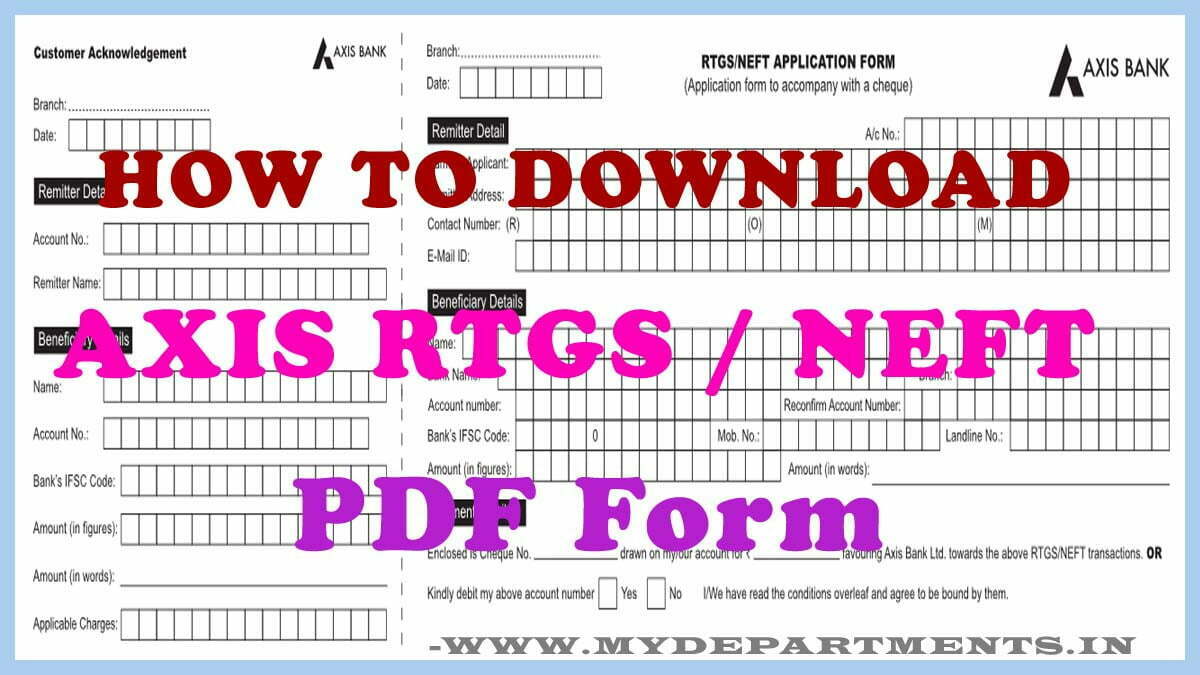

There will be two sections in the RTGS application form. One is the customer acknowledge section and the Other is for office copy. Again in these two sections, the remitter detail and beneficiary detail section will be present.

Remitter Details Section

- Remitter account number

- Enclosed cheque number

- Date of transaction

- Address of the remitter bank branch

- Name of the remitter

- Email id & Contact number (optional)

Beneficiary Details Section

- Name of the beneficiary

- Account number of the beneficiary

- IFSC and name of the beneficiary bank

- Amount in numbers and words

How to Download AXIS Bank RTGS PDF Form | AXIS Bank NEFT PDF Form

Customers can download PDF forms online. Take a photocopy of the application form. Fill and can go to the bank to make a transaction. It will save time and effort for the customers. Customers can download AXIS Bank RTGS/NEFT Pdf form below. Click the link.

AXIS Bank RTGS Charges

RTGS is used to transfer large amounts. The transaction service charges for axis RTGS are given below. No charges will apply on RTGS transactions made online.

| RTGS Amount (Rs) | Transactions service charge (Rs) |

| 2 Lakhs to 5 Lakhs | 25/- (Exclusive of Taxes) |

| Above 5 Lakhs | 50/- (Exclusive of Taxes) |

AXIS Bank NEFT Charges

NEFT transactions are useful to make payments up to 2 lakhs. Different charge slabs are presently based on the amount. The below table will give information about AXIS NEFT charges. No online is applicable for NEFT made online.

| RTGS Amount (Rs) | Transactions service charge (Rs) |

| Up to 10,000/- | 2.5/- |

| 10,000/- to 1,00,000/- | 5/- |

| 1,00,000/- to 2,00,000/- | 15/- |

| Above 2,00,000/- | 25/- |

Axis Bank Timings

Axis NEFT transactions can make in online and at the bank branch. In the bank branch, Customers can make NEFT during bank working hours. Different timings are followed to make NEFT online.

| Banking Days | Timings |

| AXIS NEFT on working weekdays (From Monday to Friday) | Branch working hours |

| NEFT on working Saturdays | Branch working hours |

| NEFT on Sundays and National Holidays | Transactions are not allowed |

Times to make Axis bank rtgs transactions are given below. Anyway, AXIS real-time gross settlement can be made online 24×7. Time will be followed to make transactions in the branch.

| Banking Days | Timings |

| AXIS RTGS on working weekdays (From Monday to Friday) | 08:00 AM to 6:00 PM |

| RTGS on working Saturdays | 08:00 AM to 6:00 PM |

| RTGS on Sundays and National Holidays | Transactions are not allowed |

For more information. You can visit the AXIS website link given below.

NEFT: https://www.axisbank.com/bank-smart/internet-banking/transfer-funds/neft

RTGS: https://www.axisbank.com/bank-smart/internet-banking/transfer-funds/rtgs

Frequently Asked Questions

How can I NEFT / RTGS in Axis Bank?

Axis bank customers can make RTGS / NEFT transactions online, mobile banking, and at a bank branch. A minimal amount of service charges are imposed on the transaction.

What are the NEFT timings for Axis Bank?

NEFT transactions can be made online 24×7. During bank working hours at a bank branch. This transaction will process during RBI bank working hours.

Can we do RTGS online at Axis Bank?

Yes, Customers can do RTGS transactions online on the axis bank website. RTGS transactions can be made online 24×7.

Can I do RTGS from Axis mobile app?

Yes, Persons can download the “Axis Mobile – Fund Transfer, UPI, Recharge & Payment” application on android and IOS devices. Login to the Axis Mobile application. Their customers can make RTGS transactions in Axis Mobile App.

How can I do Axis bank RTGS manually?

1. Download Axis Bank RTGS / NEFT application form(or you can get an application in a bank branch.)

2. Fill the Application form

3. Attach an axis bank cheque leaf

4. Submit the application form and cheque