YES Bank RTGS form Pdf Download. How to Download YES Bank NEFT form, fill, Timings, and charges for YES Bank RTGS NEFT transaction online/offline. Check the Article to know more about these services. For more information visit the Official Website https://www.yesbank.in/.

YES Bank RTGS FORM

Real-Time Gross Settlement(RTGS) is useful for transactions of large amounts. An Amount holder in YES bank can send money to any other bank in India. Each and every transaction done through RTGS will be recorded in the Reserve Bank of India (RBI). Transactions will process individually and instantly after receiving. RTGS can be performed online with access to Internet banking / Mobile Banking.

What is the difference between the YES RTGS & NEFT form PDF?

The same form is used for RTGS and NEFT transitions in YES Bank.

YES Bank NEFT Form

National Electronic Fund Transfer(NEFT) is useful for transactions of small amounts. NEFT transactions will process in regular intervals of time. Transactions can be done online without any form. NEFT facilitates a secure, systematic, trustworthy system for funds transfer from one bank to another bank.

How to fill YES Bank RTGS / NEFT Form

Firstly see all the blocks in the form because there is more block in that form. To fill the form without any mistakes you need to follow the below steps carefully.

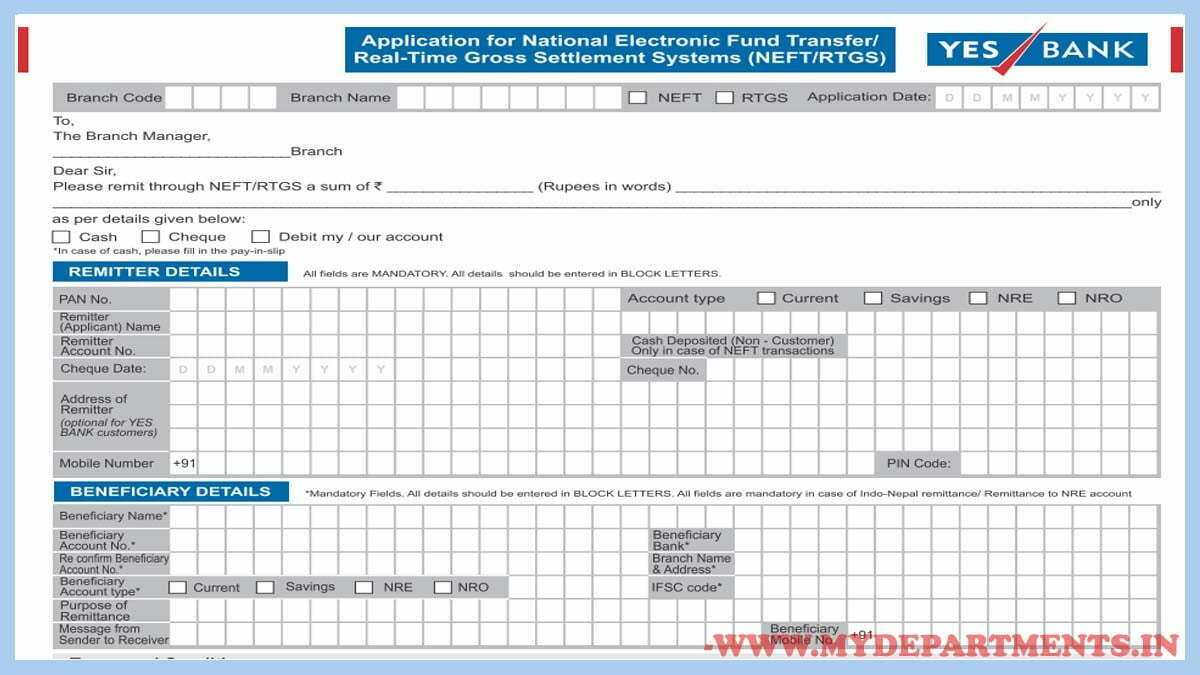

- As you see the form, you can find there are two blocks in RTGS/NEFT form. The first block refers to the “Remitter”, the second block refers to the “Beneficiary Details”, and the third block refers to the ” Customer Acknowledgement copy”.

- Fill in the Branch name, Branch code, Mode of transfer it may be RTGS/NEFT, Application date, Amount to be remitted, and Mode of remittance it may be cash, cheque, or account.

- Fill in the details like remitter and beneficiary details.

- The 1st Block is for “Remitter details” write the PAN No, Account type, Remitter name, Account No, Account type, Cheque date, and Number, Mobile No, Remitter Address, and Pin Code.

- The 2nd Block for “Beneficiary details” writes the Beneficiary Name, Account No, Beneficiary Bank, Branch Name Account type, Address, and IFSC Code, Mobile No.

- Check all the details clearly before submitting the form and make sure to sign and submit to the bank officials.

- The “For Branch/Office-Use Only” column is for bank officials to verify and sign to process the transactions.

- The 3rd block and final block for “Customer Acknowledgement” is a customer copy given by the bank to the applicant after completing the transactions where they will mention the transaction ID, Name, and sign it can be used in the future.

Download YES Bank RTGS NEFT Application Form PDF

Click on the link.

YES Bank RTGS Charges

RTGS is useful to transfer large amounts. The transaction service charges for YES Bank RTGS are mentioned below. No charges will apply on RTGS transitions made online.

| Transactions Amount | Per Transaction Charges |

| Above Rs 2 Lakhs and Up to Rs 5 lakhs | Rs 25.00 + GST Charges |

| Above Rs 5 Lakhs | Rs 50.00 + GST Charges |

YES Bank NEFT Charges

NEFT Transactions are useful to make payments up to 2 Lakhs. Different charge slabs are presently based on the amount. The below mention table will give information about NEFT charges. There is no online charge for transitions.

| Transaction Amount | Per transaction Charges |

| Up to Rs 10,000 | Rs 02.50 + GST Charges |

| From Rs 10,001 to Rs 1 Lakh | Rs 05.00 + GST Charges |

| From Rs 1,00,001 to Rs 2 Lakhs | Rs 15.00 + GST Charges |

| Above Rs 2 Lakhs | Rs 25.00 + GST Charges |

YES Bank Timings

The time to make YES Bank RTGS transactions are mentioned below. Anyway, YES Bank Real-Time Gross Settlement can be made online 24*7. Time will be followed to make transactions in the branch.

| Banking Days | Timings |

| YES Bank RTGS on working weekdays (From Monday to Friday) | 08:00 Am to 03:30 Pm |

| YES Bank RTGS on working Saturdays (Except 2nd and 4th Saturdays) | 10:00 Am to 03:30 Pm |

| YES Bank on Sundays and National Holidays | Transactions can be allowed |

YES Bank NEFT transactions can make in online and at the bank branch. In the bank branch, Customers can make NEFT during bank workings hours only. Different timings are mentioned below to make NEFT online.

| Banking Days | Timings |

| YES Bank NEFT on working weekdays (From Monday to Friday) | Branch Working hours |

| YES Bank NEFT on working Saturdays | Branch working hours |

| YES Bank on Sundays and National Holidays | Transitions are not allowed |

Useful Links:

Yes Bank RTGS NEFT Charges PDF Page: https://www.yesbank.in/pdf/basicsavingsbankdepositaccountsmartsalarycorporatebanking_pdf

Frequently Asked Questions

How can I use RTGS through Yes Bank?

YES bank provides RTGS service to its customers. Customers can make RTGS transactions both online and offline. Transaction made online 24×7 and free of cost. Transaction made in bank branch levy charges and follows particular timings.

How can I fill YES Bank RTGS NEFT form?

The same application form is used for NEFT and RTGS transactions. There will be mainly two sections. One with remitter details and another with beneficiary details.

How much time does it take for NEFT transfer in Yes Bank?

Unlike RTGS transactions, NEFT transactions will process in regular time intervals. NEFT transactions will process in batches at 30 minutes time intervals during RBI working hours.

How much money can be transferred through Yes Bank NEFT in a day?

Anyway, RBI doesn't keep any transaction limit on NEFT transactions. It depends on the Banks. There is no minimum and maximum limit for NEFT transactions in a day. There will be a certain limit for the transaction made in the YES Mobile application.