Indian Bank RTGS NEFT form download. Know more information about the timings, charges, benefits and how to fill Indian RTGS NEFT application form. Visit Indian bank official website www.indianbank.in

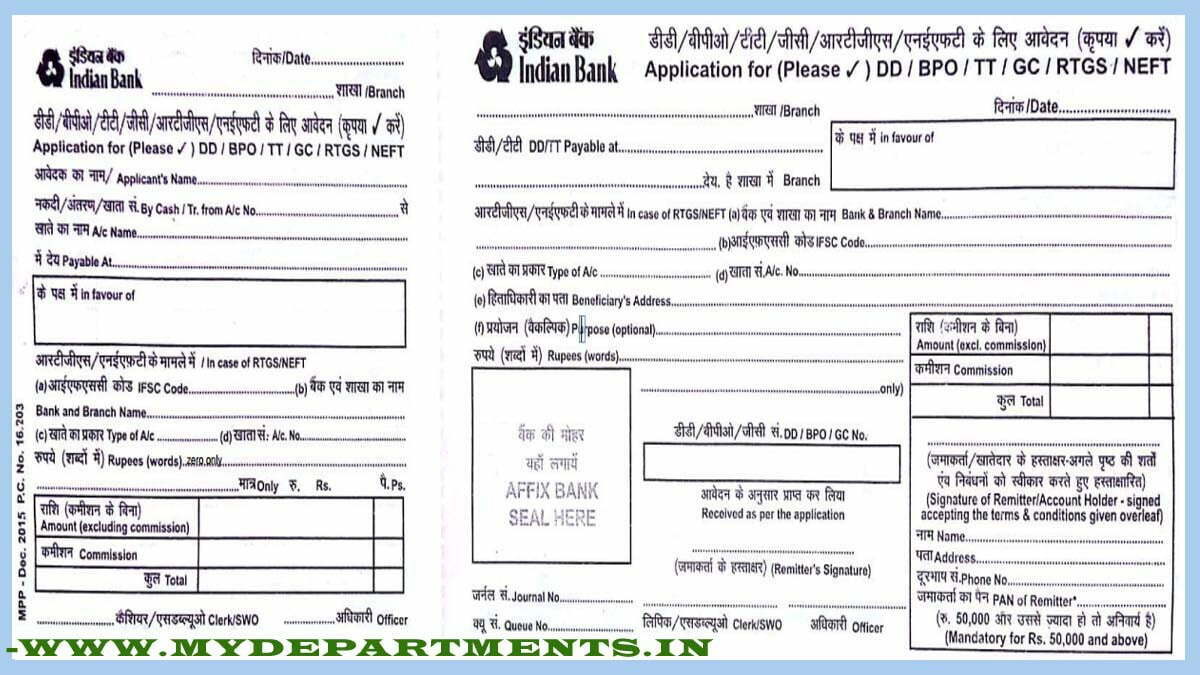

Indian Bank RTGS Form

Indian Bank was incorporated in the year1907. It is one of the old banks in India. The Indian Bank provides facilities like personal accounts, joint accounts, loans, debit cards, lockers, credit cards, and more.

RTGS (Real Time Gross Settlement) facilitates the account holder to transfer the funds to another person immediately. RTGS is done in real-time and within 30 min is done. For RTGS the minimum amount transferred should be more than Rs 2 Lakhs there is no maximum limit.

Indian Bank NEFT Form

NEFT (National Electronic Fund Transfer) facilitate a person to transfer fund from one account to another account easily. NEFT is done hourly. For NEFT there is a maximum limit of Rs 2 Lakhs.

How can customers access to RTGS / NEFT online and offline process?

Customers can do RTGS or NEFT both online and offline. If the Customer needs access to an online process then they can use Internet banking, mobile banking, and Indian Bank application. If the Customer needs to process offline they have to fill the application form of RTGS / NEFT and submit it to a bank branch to process the transaction.

How to fill Indian Bank RTGS & NEFT form Offline

- Amount to be remitted: Write the amount which should be remitted from your account.

- Account number to be debited: Mention the Indian bank account number from which the transaction amount should be debited.

- Name of the beneficiary bank and branch: Clearly mention the beneficiary of your transactions and branch of the beneficiary.

- IFSC Code: IFSC Code is very important. fill receiving branch IFSC Code.

- Name of the beneficiary customer: fill in the Customer’s name without any mistake.

- Account number of the beneficiary customer: Write carefully and check twice the account number.

- Submit: Submit to the bank officials.

Download Indian Bank RTGS NEFT Form PDF

You can download the India Bank RTGS form PDF from this web page. Click on the link.

Indian Bank Charges

All the charges through E-Banking are free there are no additional charges. For both RTGS or NEFT the inward charge is Zero for all the transactions.

| Amount | Transaction Services Charges(Rs) |

|---|---|

| Rs 2 lakhs to Rs 5 lakhs | 25/- (Exclusive of GST) |

| Above Rs 5 Lakhs | 50/- (Exclusive of GST) |

| Amount | Transaction Services Charges(Rs) |

|---|---|

| Up to Rs 10,000 | 2.50/- (Exclusive of GST) |

| Rs 10,001 and up to Rs 1 lakh | 5/- (Exclusive of GST) |

| Rs 1 lakh to Rs 2 lakh | 15/- (Exclusive of GST) |

| Rs 2 lakh | 25/- (Exclusive of GST) |

What is timings for RTGS and NEFT in Indian Bank?

NEFT transactions can be done 24*7 through online services like Mobile banking, Internet banking, etc.

Indian Bank Timings

| Workings Days | Timings |

|---|---|

| On Working Weekdays Monday to Friday RTGS | 09:00 AM to 4:30 PM |

| On Working Saturday RTGS(except 2nd and 4th Saturday) | 09:00 AM to 1:00 PM |

| On Sundays and Public Holidays RTGS | Transaction cannot be done |

| Workings Days | Timings |

|---|---|

| On Working Weekdays Monday to Friday NEFT | 09:00 AM to 05:00 PM |

| On Working Saturday NEFT (except 2nd and 4th Saturday) | 09:00 AM to 02:00 PM |

| On Sundays and Public Holidays NEFT | Transaction cannot be done |

Customer Care for RTGS / NEFT Related Issues

First, contact the nearby bank. If the issue doesn’t get solved. Contact the Head Office through the mail RTGS cell, Head Office, Chennai.

| Service | Email ID |

|---|---|

| RTGS cell, Head Office, Chennai | rtgscell@indianbank.co.in |

| NEFT cell. Head Office, Chennai | nefthelpdeskncc@rbi.org.in |

If still not resolved. Contact the customer care service of the Department of RBI. Send the e-mail to cgmscsd@rbi.org.in.

Benefits of RTGS & NEFT

RTGS:

- It is a safe and secure system for funds transfer.

- This is the real-time transfer of funds to the beneficiary account.

- The remitter need not use any of the physical cheques.

- RTGS transactions of funds have no amount cap.

- Remitter can do both the transactions through online(through internet banking, mobile banking) and Offline

NEFT:

- Real-time funds transfer to the beneficiary account and settlement in a secure and safe way.

- Pan- India coverage through a large network of branches.

- NEFT system can be used for a variety of transactions including the payment of credit card dues, payment of EMI, etc.

- Confirmation email / SMS to the remitter and the beneficiary account holders.

- Round the clock availability on all days of the year through online.

Frequently Asked Questions

How long will it take to transfer money through NEFT?

The transactions between banks are processed and settled in bank branches within one hour.

Is it mandatory to have an internet banking account to avail NEFT facility?

To make the fund transfer through the Net banking it is mandatory. To make the transaction through the bank it is not required.

Can an account holder receive foreign remittances through NEFT?

NO. All NEFT funds transfers are only possible in India only.

Can an account holder send money to other country account holder through NEFT?

NO. It cannot be done. All the transactions should be done in India.

For more information visit the official website of Indian Bank official website. https://www.indianbank.in/